Created to improve operations at SMU and identify savings in administrative costs to reallocate to academic purposes, the Office of Operational Excellence has identified key measurements to track progress towards its mission. At the beginning of the Operational Excellence for the Second Century (OE2C) project, research revealed that our peers across aspirational universities are spending a greater percentage of funds on the academic mission versus administration costs.

To measure SMU’s progress toward achieving a competitive balance of academic and administrative spending through bold initiatives that serve the staff, faculty, and students, the Office of Operational Excellence has identified a set of key metrics.

Below, you’ll find key metrics from Contracts including the following Q&A with team leaders.

Why were these particular performance metrics chosen to represent progress toward operational excellence in your area?

The goal of the Contract Administration Initiative was to align risk tolerance and business need to simplify the contract process University-wide. During the diagnostic phase of the initiative, the team conducted 21 individual interviews, 5 group/department interviews, 3 focus group interviews and 3 end user/faculty group interviews across campus. The length of time it took to process a contract was the biggest challenge identified campus-wide. The general consensus was the contract process needed to be more nimble, efficient and faster. The goal was to also decrease the number of contracts going to the Office of Legal Affairs and Office of Risk Management so they can focus on more high-risk issues. To achieve the goal of decreasing the number of contracts going to OLA and Risk, we needed to increase the number of standard contracts used across campus and increase the number of contracts that could be handled through Purchasing on a Purchase Order.

How do these metrics support the work of your OE2C initiative?

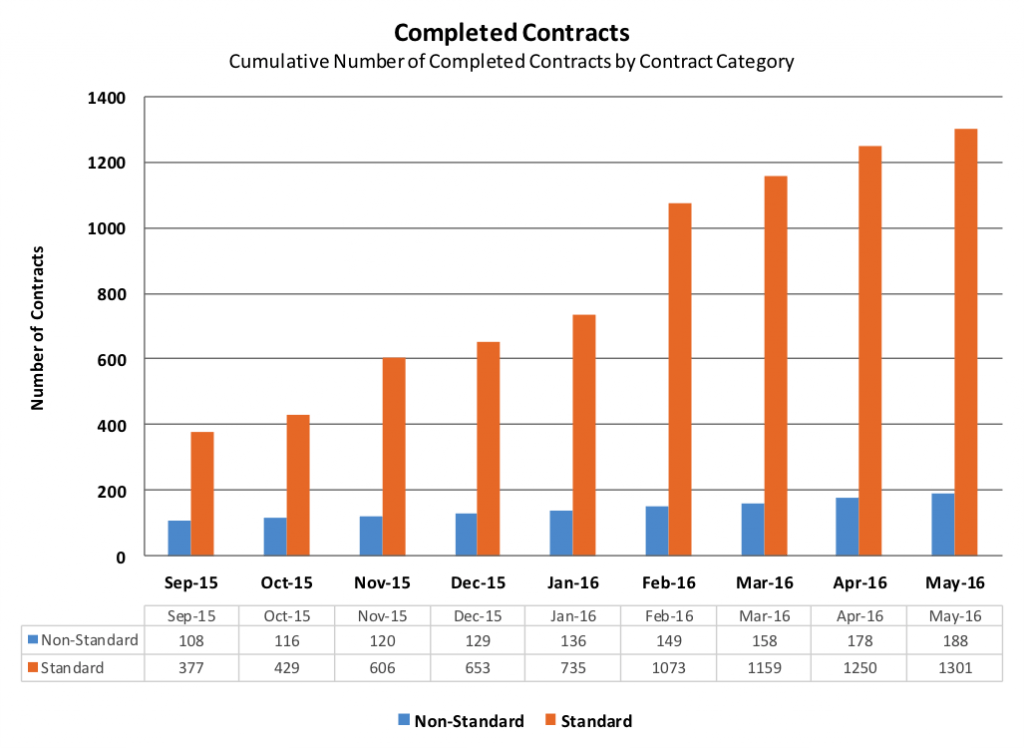

Slide 1 reflects the following:

- The number of standard contracts being used across campus.

- The number of non-standard contracts being used across campus.

- The decreased number of contracts requiring legal and risk review (i.e. standard contracts do not require legal and/or risk review)

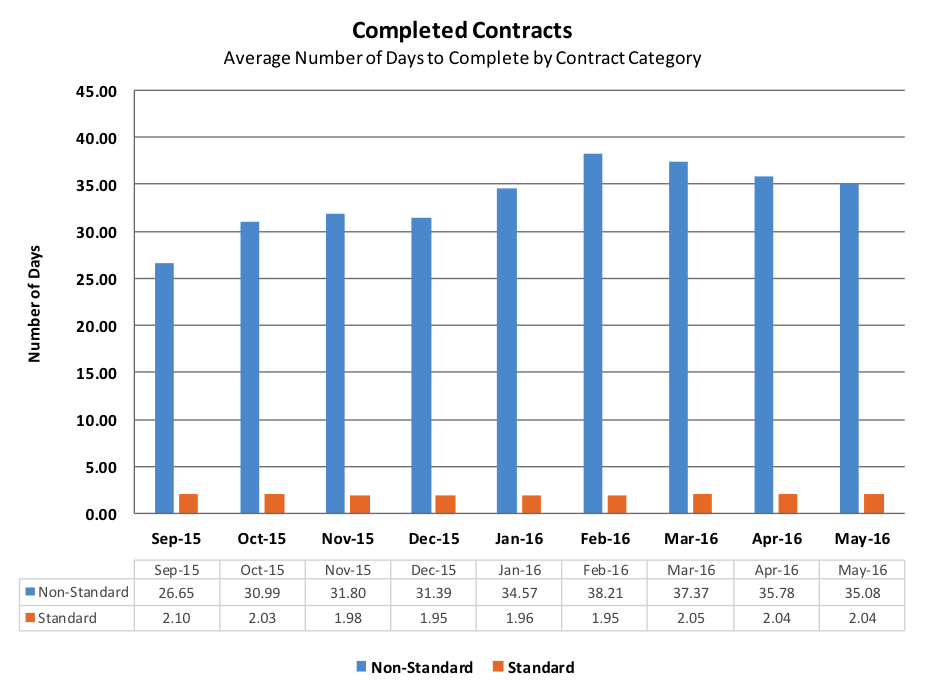

Slide 2 reflects the following:

- The number of days it takes to process non-standard contracts (i.e. require legal, risk and other resource review)

- The number of days it takes to process standard contracts (note the benefit of using standard contracts)

Slide 3 reflects the following:

- The average number of days it takes for contracts to be reviewed by the various resource groups across campus. (note all contracts reviewed by legal, OIT and risk are all non-standard contracts)

Slide 4 reflects the following:

- The number of open standard and non-standard contracts open at the end of each month.

Slide 5 reflects the following:

- The average number of days standard contracts and non-standard contracts remain open at the end of each month. (note the benefit of using standard contracts)

Slide 6 reflects the following:

- The average number of days contracts have been opened by the resource group.

Slide 7 reflects the following:

- The number of contracts that were presented to the new contract administration process which were moved to the purchasing process.

Looking at your performance measures, what findings are most interesting or compelling to you?

The low number of days it takes to process standard contracts across campus and the volume of those contracts.

Through this initiative, the number of contracts going for Legal review has decreased by 90%.

1301 Standard Contracts

188 Non-Standard Contracts to legal affairs

393 Contracts to Purchasing

1882 Total Contracts

188 is 9.989 % of 1882

Previously, OLA would have received ALL of these contracts.

What are your main areas of focus going forward?

Continued training of the contract leads with the assistance of Legal Affairs, Risk Management, Human Resources, OIT, etc. With training by these various resource groups in their areas of expertise, we can increase the proficiencies of the contract leads, who are the first set of eyes on non-standard contracts, and help them determine which resources groups need to review which contracts.

Any other thoughts you would like to share?

This progress is reflective of the hard work and determination the Contract Administration Team put forth in designing and implementing the new process. The progress is also reflective of the 30 contract leads embedded within the schools and departments across the campus. The contract leads have worked tirelessly to put business practices together within their schools/departments, have attended numerous training sessions and have taken on the challenge of learning and using the new software that all contracts are now processed through. The numbers also represent the University’s implementation of DocuSign, which has significantly decreased the number of days it previously took to pass hard copies of contracts around campus to sign. The President, Vice Presidents and others with signature authority have embraced the use of DocuSign, and this has been a successful part of this initiative.

The Contracts Institutional Metrics Dashboard

- Completed contracts reflect all contracts completed since the new contract administration process was implemented on April 15, 2015. Beginning in September 2015, SMU went live with Selectica’s Contracts Lifecycle Management software and contracts are now being reported with Selectica’s reporting feature. Prior to Selectica launching, contracts were tracked manually on spreadsheets.

- SMU Resources are departments and/or individuals with expertise in various areas of contract management.

- The Office of Legal Affairs (OLA) has prepared standard forms to be used across campus. If there are no special requirements or deviations from accepted OLA language, contracts can be processed for signature without review by SMU resources.

- Non-Standard contracts require review by appropriate SMU resources as necessary.

- This data does not include employment, endowment, grants and purchase orders which are outside of the new contract administration process.

- Completed Contracts reflect all contracts completed since the new contract administration process was implemented on April 15, 2015. Beginning in September 2015, SMU went live with Selectica’s Contracts Lifecycle Management software and contracts are now being reported with Selectica’s reporting feature. Prior to Selectica launching, contracts were tracked manually on spreadsheets.

- SMU resources are departments and/or individuals with expertise in various areas of contract management.

- The Office of Legal Affairs has prepared standard forms to be used across campus. If there are no special requirements or deviations from the accepted OLA language, contracts can be processed for signature without review by SMU resources.

- Non-Standard contracts require review by appropriate SMU resources as necessary.

- This data does not include employment, endowment, grants and purchase orders which are outside of the new contract administration process.

- Completed contracts reflect all contracts completed since the new contract administration process was implemented on April 15, 2015. Beginning in September 2015, SMU went live with Selectica’s Contracts Lifecycle Management software and contracts are now being reported with Selectica’s reporting feature. Prior to Selectica launching, contracts were tracked manually on spreadsheets.

- SMU resources are departments and/or individuals with expertise in various areas of contract management.

- Number of days in each of the SMU resources group reflects the time from the date a contract request was made to the resource groupthrough the date of approval of the resources group. At any point a contract is with an SMU resource group, the time period can include but not limited to review by vendor’s lawyers and business personnel and review by personnel in the originating SMU Department, Office of Information Technology, Office of Risk Management, Office of Legal Affairs and Contracts office.

- Open Contracts reflect the total number of open contracts in the new contract administration process.

- Open contracts in queue reflect the number of days on average for the remaining contracts that have not been completed according to their contract category.

- The open contracts could be in various stages of approval within the University or with the vendor or vendor’s counsel.

- Open contracts in queue reflect the number of days on average the remaining open contracts have been open according to the resource group.

- Number of days in each of the SMU resource groups reflects the time from the date a contract request was made to the resource group through the date of approval of the resource group. At any point a contract is with an SMU resource group, the time period can include but not limited to review by the vendor’s lawyers and business personnel and review by personnel in the originating SMU department, Office of Information technology, Office of Risk management, Office of Legal Affairs and Contract Office.

- With changes in the contracts administration process and keeping in line with the procurement initiative and the travel policy, contracts which formerly went through the contracting process have now been moved to purchasing. Examples of these include but are not limited to contracts for hotels, catering, events, media, transportation, entertainment, printing and promotional items.

- As the Contract Leads receive additional training, they will become more familiar with what needs to be processed through purchasing versus the contract process.

- *The sudden increase in November 2015 is attributable to the fact that a number of contract leads were transferred to other shared services centers. The move necessitated the need for new contract leads to be identified and trained. The process took most of October and part of November.

- The increase in May 2016 is likely attributable to graduations and events, which may have made contract leads unsure if items should

be a PO or contract.

See more metrics in the coming weeks on our website or by subscribing to Operational Excellence’s email digest.